Dear Neighbor:

How are you today? During these extraordinary times, this otherwise familiar greeting has taken on a new significance, and I want to reassure you that we are here to listen and provide support. Our office along with our incredible volunteers are busy making thousands of wellness calls each week. If you or anyone you know is in need of help, please let us know.

This month, many are preparing to celebrate the holidays of Easter, Passover and Ramadan, and we must find new ways to observe them so that we stay connected to our faith traditions without placing the health of our communities at risk by gathering in person. Celebrations will be different this year, and that’s okay. We will get through this.

My family is planning a “Zoom Seder” and, while we will all miss being physically present with all our friends and loved ones, this is absolutely necessary to ensure that we can return to life as normal sooner rather than later.

If we choose to ignore the advice of our healthcare professionals and congregate because it’s warm outside or because it’s a holiday, it will set our state back.

Be Mindful. Stay Home. Stay Strong.

We will get through this TOGETHER! #AllinIllinois

Warm Wishes,

Jennifer

Representative Jennifer Gong-Gershowitz

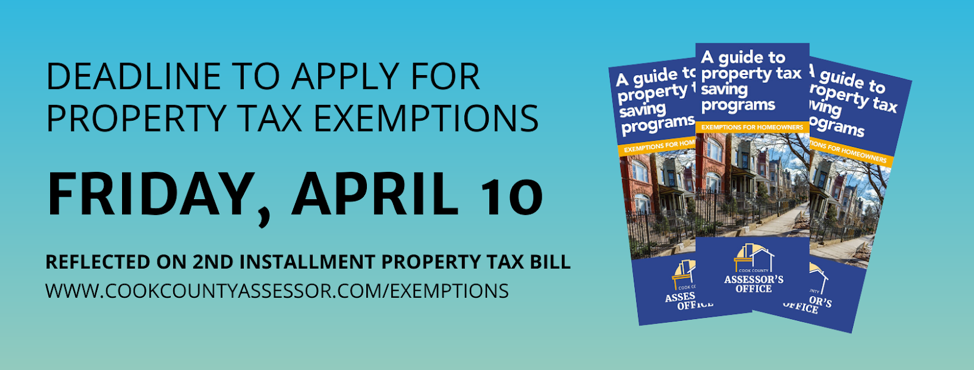

Attention Property Owners: Exemption Filing Deadline – Friday, April 10

We wanted to remind Homeowners that the deadline for applying for exemptions on your property taxes is this Friday, April 11, 2020. Exemptions are for tax year 2019 and will be applied by the Treasurer’s Office on the second installment property tax bill. For more details on these exemptions and to apply, click here.

Federal CARES Act: What it means for you

On March 27, 2020 Congress passed the Coronavirus Aid, Relief and Economic Security (CARES) Act, which represents the largest economic relief package for individuals and small businesses impacted by the COVID-19 pandemic.

Major provisions of the CARES Act include:

Economic Stimulus Payments

Individuals making up to $75,000 and married couples making up to $150,000 will receive full payments. Above these income amounts payments will reduce by $5 for each $100 above the income thresholds. Incomes exceeding $99,000 for individuals and $198,000 for joint filers with no children are not eligible.

Eligible taxpayers who have filed tax returns in 2019 or 2018 will automatically receive $1,200 for individuals and $2,400 for married couples. Parents will also receive $500 per qualifying minor.

On April 1, the US Treasury Department and the IRS announced that Social Security beneficiaries who do not typically file tax returns, will automatically receive payments to their bank account or by check based on their current Social Security payment settings.

When will I receive my stimulus payment?

Approximately 60 million Americans will receive payments through direct deposit in mid-April, likely the week of April 13th. About three weeks following electronic payment deposits (the week of May 4th), the IRS will start issuing the paper checks. Checks will be disbursed in reverse “adjusted gross income” order, beginning with the lowest income first, and will be issued at a rate of 5 million a week.

What identification requirements are needed to receive this payment?

Taxpayers must have a Social Security number for themselves and their qualifying children in order to receive and direct cash payment.

Will I be taxed on my payment?

No.

Do I need to repay my payment?

No.

Unemployment Benefits

Individuals who qualify for unemployment benefits, will now receive an additional $600 per week under the CARES Act implementation through July 31, 2020. The length of benefit has also been extended under the Act. Illinois currently provides 26 weeks of unemployment benefit, an additional 13 weeks is now available. Both of these benefits will be automatically calculated when an individual applies.

How do I apply for unemployment benefits?

Unemployment Insurance is administered by the Illinois Department of Employment Security (IDES). Individuals can apply online here or by phone at 1-800-224-5631. In order to process the extremely high volume of unemployment benefit claims due to COVID-19, IDES had implemented a filing schedule for both online and phone claims based on last name.

Apply for Unemployment Benefits

Information on Filing Schedule

Do self-employed individuals or 1099 contract workers qualify under the expansion?

Typically, self-employed workers do not qualify for unemployment benefits. However, the CARES Act permits states to expand benefits in cases where unemployment is connected to COVID-19. This will include self-employed workers, independent contractors, “gig-economy” workers, and any prevented from starting a new job because of the crisis. The Illinois Department is Employment Security (IDES) is now working to implement this broader eligibility.

How does this apply to non-profit organizations?

Ordinarily, nonprofit organizations are required to cover 100% of unemployment taxes through “reimbursable arrangements” with the State. During this national emergency, the federal government will be providing a 50% match of these expenses for non-profits. Additionally, these employees are eligible to receive the supplemental $600 per week.

IDES is currently working to implement components of the Federal Stimulus package. Individuals eligible for these program expansions should continue to monitor the IDES website for further information on applying for unemployment benefits. All individuals applying should be persistent in filing unemployment claims. If my office can be of any assistance, please contact us by email at Info@GongGershowitz.com or by phone at 847-486-8810.

Small Business and NonProfit Relief

Additional information on state and federal emergency resources for small businesses and nonprofits is available on our small business and nonprofit resources webpage on our website www.GongGershowitz.com.

Paycheck Protection Program (PPP)

The Paycheck Protection Program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits. Funds will be offered in the form of loans, which will be fully forgiven when used for payroll costs, interest on mortgages, rent, and utilities (due to likely high subscription, at least 75% of the forgiven amount must have been used for payroll). Forgiveness is premised on employers maintaining or quickly rehiring employees. Loan amounts will reduce for loss of full-time headcount or if salaries and wages decrease.

Who is eligible to apply?

- Small businesses with 500 or fewer employees are eligible, which includes — non-profit organizations, veterans organizations, tribal concerns, self-employed individuals, sole proprietorships, and independent contractors, and

- Businesses in certain industries that have more than 500 employees – SBA’s size standards for those industries.

When can I apply?

- Starting April 3, 2020, small businesses and sole proprietorships can apply through existing SBA lenders

- Starting April 10, 2020, independent contractors and self-employed individuals can apply through existing SBA lender

SBA FAQ for Faith Based Organizations on PPP and EIDL Programs

Economic Injury Disaster Loans

In response to the Coronavirus (COVID-19) pandemic, small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000. This advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available following a successful application. This loan advance will not have to be repaid.

Who is eligible to apply?

- Small business with less than 500 employees – including sole proprietorships, independent contractors and self-employed persons, private non-profit organizations or 501(c)(19) veterans organizations affected by COVID-19, and

- Businesses in certain industries that have more than 500 employees – SBA’s size standards for those industries.

Economic Injury Disaster Loan advance funds will be made available within days of a successful application, and this loan advance will not have to be repaid.

SBA FAQ for Faith Based Organizations on PPP and EIDL Programs

Economic Injury Disaster Loan application

On March 25, Gov. Pritzker announced a new package of emergency assistance programs for small businesses in need of additional capital, totaling more than $90 million dollars. Information about these Grants and Loans including eligibility, application information and when the funds will be disbursed is available on the SBA Initiatives webpage on the Illinois Department of Commerce and Economic Development website.

Where can not-for-profits apply for financial relief?

Currently, two different COVID-19 grant programs have been launched for non-profits in Illinois. The Chicago Community COVID-19 Response Fund will support local nonprofits by providing them with grants so they can continue to serve the City of Chicago and surrounding suburbs. The Illinois COVID-19 Response Fund will provide grants to nonprofits and local community foundations across the state. Nonprofits must apply for funding, and grants may be announced in multiple rounds. Nonprofits can also apply for the SBA Disaster Loan. For additional information on this loan program, please visit the SBA Disaster Loan website at https://disasterloan.sba.gov.

Will Insurance companies be required to cover some damages, such as lost revenue due to COVID-19? Will there be any guidance for small businesses to make a complaint?

For business insurance inquiries, please visit https://mc.insurance.illinois.gov/messagecenter.nsf

Will private insurance companies waive costs related to COVID-19 for its consumers?

Humana and Cigna Insurance companies will cover co-payments and cost-sharing for treatments related to COVID-19. A list of actions by health plans can be reviewed here.